This was originally posted by Kol Peterson on his website: https://www.buildinganadu.com/. Thank you Kol for providing great information on ADUs and letting us share this information with our community.

A RECESSION-PROOF INVESTMENT

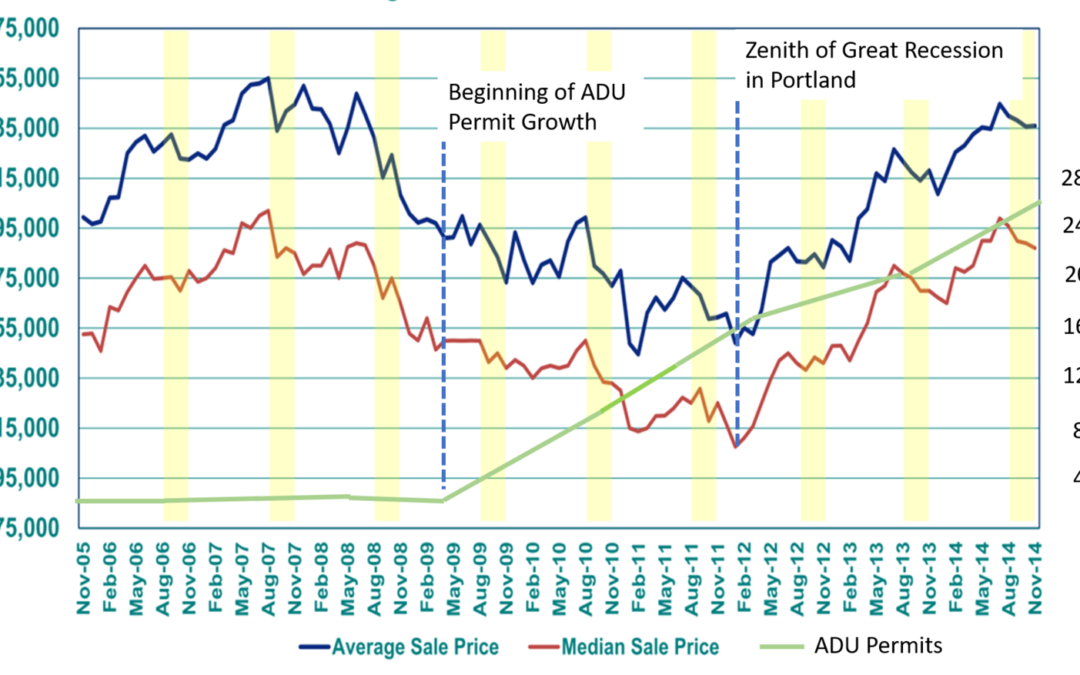

2010 was the zenith of the Great Recession in Portland. The real estate market had shuttered in many areas of the country around that time. While Portland was buffered from the worst of this crash, it was still a jarring time for many residents who had lost considerable value in their most significant financial asset.

What sticks out to me, when considering the growth of ADUs in Portland, is that the residential real estate market for homes was receding rather dramatically in 2010 with no predictable bottom in sight.

Nonetheless, it was 2010 is when ADUs started their rapid ascent in popularity.

It would be false to attribute the growth of ADUs solely to the 2008 recession, but it is fair to say that ADUs did in fact, begin their ascent when the real estate market was still crashing in Portland.

There’s every reason to believe that ADUs can do just fine in a recession. Rationale actors may realize that ADUs are one of the safest places to invest their money in a recession.

March, 2020’s sudden and dramatic economic crisis portends far greater economic consequences than the housing crash of 2008.

These economic impacts are catastrophic, life-changing, and profound. If you aren’t directly impacted yet, you will be by the end of April, 2020.

Here’s just a few of ways that the Coronavirus has already impacted my various side hustles.

-

My biggest ADU event of the year was scheduled for April. 60% of the registrations were already filled 7 weeks out. That event has now been called off. Hopefully it’s postponed just a few months; but potentially it will stay postponed till after the vaccine is widely available.

-

My ongoing in-person ADU classes for homeowners and realtors are both cancelled.

-

One rental property of mine has two units (a house and an ADU), and every one of the 20-something renters in those two units worked in restaurants, and was been laid off last week. They’re not sure they’ll be able to make rent for more than one month.

-

My tiny house hotel business has lost over 40 booking cancellations in the last two weeks for March and April. For a very small, boutique hotel, that is a catastrophic hit. For this time ever in our business, someone was laid off two weeks ago. This was in part to preserve the jobs of single moms who work part time. Four days later, as almost every booking from our calendar has cancelled, we determined that all staff should potentially be laid off to be able to collect unemployment. We’re pivoting to solely serving people impacted by COVID-19 on a weekly or monthly basis at greatly reduced rates, practically overnight.

From severe supply chain failures, to NGO closures, to restaurants, stores, venues, gyms, and theaters never opening back up, these economic impacts will be deeply personal and emotionally wrenching for all of us.

These economic impacts will be on top of the unfolding human health catastrophe, and on top of the radical changes we’ve all suddenly been compelled to make both socially and physically.

THE CLIMATE CONNECTION

The Coronavirus Pandemic is medical, it’s physical, it’s metaphysical, it’s unavoidable, it’s deep, it’s emotional, it’s economic, it’s scary, it’s everywhere. It’s biblical.

It’s allegorical.

This series of cataclysmic news events we’re experiencing each day, are allegorical in the sense that this can be understood as a time-limited trial run for the much larger crisis that is also imminent and unavoidable- climate change.

Climate change is now immediately on the horizon. Just as most of us haven’t yet witnessed the human health impacts of Coronavirus (as of March 25th, 2020) , we also can’t quite yet viscerally feel the impacts of climate change.

Coronavirus is a 12-18 month sample of the type of high impact global events that will be with us from now on. That we’re in this pandemic together is obvious to us as we hunker down in solitude and sacrifice in the face of staving off the worst human life impacts of Coronavirus.

Coronavirus is also an opportunity to galvanize the human response globally. We’re all in this together; and we must work together to get through this challenge.

Meanwhile, before the Coronavirus is dealt with, we’re statistically likely to witness tens, probably hundreds, of huge fires and hurricanes, sea surges, and other flooding events, fueled directly by a rapidly changing climate. Given the projections of Coronavirus hospital bed shortages, these additional climate fueled disasters are going to add insult to injury.

This Coronavirus Recession will continue to ravage our economy for a long time. Not to be dour, but some degree of economic collapse is where we’re likely headed, even with a record breaking stimulus package.

Whole sectors of the retail economy have just gone extinct overnight. There are profound changes to the retail economy happening each hour. Some of these impacts will be temporary. But, many will be permanent. Potentially millions of working people will need to shift to new jobs in non-retail sectors.

So, when we talk about solutions, on top of dealing with a never-ending series of climate crises, we have to start to consider shifting whole sectors of the economy.

ENTER, ADUS

Mostly, I like promoting ADUs because they’re self-serving. They’re an easy sell, because ADU development is, in fact, an incredibly self-serving thing to do with your money.

With an ADU, you’re investing right directly into your future self. Once you’re done, you immediately add substantial extra income in your life if you rent one unit. That income will generally be greater than the costs of additional payment for the amortized construction loan for the project.

Furthermore, you’re adding significant long-term resale value to your property.

You’re also gaining extraordinary flexibility with your property.

An ADU can shift its functional roles in life fairly easily from a home, to an office, to a guest room.

I suspect many ADUs used as short term rentals will be getting out of that use now that the market will dry up overnight. Some ADUs will change into super awesome Coronavirus recovery and isolation shelters, if that’s what becomes collectively needed. Here’s the first example of that type of use I’ve seen documented.

With aspiring homeowner developers, I don’t typically focus on the civic motivations of why everyone should build them.

But, now it’s important for all homeowners to take new factors into consideration. The next 1-3 years is the timeframe to act on the idea of developing an ADU.

I’ve never had to phrase ADU development in quite these terms, but with the Coronavirus Recession, homeowners should start to consider it a civic duty to consider putting an ADU (or two) on their property.

ADUs offer the U.S. the chance to achieve several key policy goals at this point in time, which I’ll enumerate below. But, they suddenly offer something new and critical and timely; a chance for us to help our communities save themselves from the impending economic outfall of the Coronavirus.

ADU development is not something that the federal government would or should ever mandate. But if you’re a west coast homeowner, I’d like you to consider that by not at least considering building an ADU:

-

you’re causing climate change

-

you’re causing the affordable housing crisis

-

you’re not stimulating the economy

-

you’re not contributing $100K to help make a much-needed shift for the post-Coronavirus Economy.

Homeowners should now consider ADU development as a civic duty. ADU development may be the only, rationale, viable way that average homeowners can collectively muster a significant, grassroots economic response to the damage from the Coronavirus Recession.

We will all do our parts to pitch in to help our local economy, I’m sure, but average homeowners aren’t going to pitch in over $100K for the good of the order. Heck, aside from construction projects, I can’t even think of a situation in which I’ve ever directly infused more than $1,000 into the local labor economy.

An 800 sq ft detached new construction ADU in Portland in 2019 cost an average of $210K to develop. As a general rule of thumb, half of that cost is for material, half is for labor. So, it’s fair to guess that homeowners are spending roughly $105K in local labor jobs.

Even if only 1 in 100 homeowners built an 800 sq ft ADU, that homeowner is effectively providing 100 people with $1,000+, or 10 people $10K+, or 2 people with $50K.

One ADU adds a lot of available capital into the local labor market. And, the other $105K of the $210K is spent both locally and globally in a variety of manufacturing industries and supply chains.

Granted, this is a lot of cash for homeowners to spend. Except, in many cases, they don’t have to front it anymore.

Financing for ADUs has actually gotten quite good, at least on the west coast. These days, savvy homeowners can simply leverage financing options to build an ADU. Homeowners can use institutional money from banks and investors, capture and insert that cash directly into the local labor market, reducing or entirely eliminate their out-of-pocket costs. Furthermore, many of the ADU loan options that are popping up are mission driven, and are attempting to reach those who wouldn’t normally qualify for an ADU construction loan.

And, if the issue is that the homeowner just don’t qualify for quite enough money, there’s also less expensive ADUs that are becoming more broadly available. There’s several prefab companies operating now that have delivered tens, hundreds, of prefab ADUs for under $100K all in up and down the west coast. More companies are entering into the prefab ADU space to compete, including the largest manufactured home builders in the country.

CITIES NEED TO DO THEIR PART BY DRASTICALLY IMPROVING ADU REGULATIONS

Most of the country still has poor, or very poor, ADU regulations by my standards. But, as of January, 2020 all of California, all of Oregon, and the City of Seattle, have objectively good regulations.

Governments of high cost cities that condone rules that obstruct ADU development in single family zones should know what they need to do by now to make ADU development palatable. The formula to liberalize ADU code has been spelled out pretty clearly at this point in my book, on this website, and in many journal articles.

Since it’s proven to be challenging politically to actually pass decent ADU ordinances at the local level, states legislators are now stepping in to provide a decent regulatory baseline for ADU development statewide. So, that’s an option too.

For policy makers, here’s a summary of where we are with ADUs as a general policy matter, and why it matters:

We know that housing costs too much for most people. (1)

We know that many or most people are cost burdened by housing. (2)

We know that we need to increase the supply of housing.

We know that developed urban land is dominated by single family residential zoning. (3)

We know that more small units are needed. (4)

We know that consumers prefer to live in residential areas. (5)

We know enough of what we need to know now about ADUs. We can now safely make a needed shift in a large part of the west coast labor force into ADU development.

But, this requires homeowners to build ADUs.

CALL TO ACTION FOR HOMEOWNERS

Homeowners, consider this a call to action.

Build an ADU, now. If you’re a homeowner in a west coast market, and have been sitting on the fence about developing an ADU, the next 1-2 years is the time to do.

If you know another homeowner who you think should build an ADU, send this post them.

It will not only be a necessary time to help stimulate the local economy, it will be a good time to get better value for your dollar overall.

Alternatively, maybe you find yourself suddenly out of a job and have some time on your hands? You can offset the cost of ADU construction with some of your own sweat equity and make really productive use of your free time.

ADU will in and of themselves not save us, but they are destined to become an essential public policy linchpin of the post-Coronavirus economy.

Footnotes

1) https://accessorydwellings.org/2019/08/22/adu-legislative-initiatives-history-in-the-making-part-ii/

2) Price-to-Income Ratios are already at an all time high. https://www.jchs.harvard.edu/sites/default/files/Harvard_JCHS_State_of_the_Nations_Housing_2019.pdf

3) https://www.nytimes.com/interactive/2019/06/18/upshot/cities-across-america-question-single-family-zoning.html

4) https://www.theatlantic.com/family/archive/2019/09/american-houses-big/597811/ 5) 57% to 39% prefer single family detached over multifamily https://www.nar.realtor/blogs/economists-outlook/latest-consumer-preference-survey-from-nar-s-smart-growth-program